Market Update: September

WME's Senior Market Analyst provides a monthly market update for September

WME's Senior Market Analyst provides a monthly market update for September

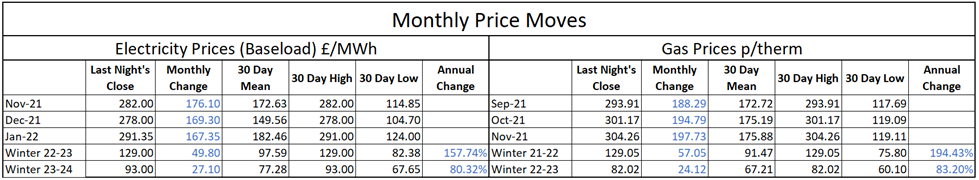

Gas and electricity prices have surged higher in the last month, breaking new highs on a daily basis

Low European gas storage levels along with high Asian gas prices continue to drive the markets as we approach the winter heating season

Low Russian gas flows continue to add support to the markets

LNG flows remain very low as a result of a sharp fall in incoming LNG cargoes

Looking ahead, prices will be influenced by:

Detail

Gas and electricity prices have increased to levels, and at a pace, never seen before in the last month, with unprecedented volatility. At one point yesterday gas prices for the winter months were up 60p on the day, an increase of 25% before losing some value at the end of the day. Some of the winter months closed above £3 per therm - to put this into some perspective, this equates to in excess of 10p/kWh. Exceptionally low European gas storage levels, high Asian gas prices, a recovery in Global demand and low LNG supply continue to drive the markets.

Day Ahead Gas

Day Ahead gas prices reached their highest recorded levels yesterday, surpassing the £2.30 seen for one day in March 2018 which was due to the ‘Beast from the East.’ Again, to put these increases into some perspective, gas prices for November have increased by 124% since the beginning of September. One reason for these increases has been a continued lack of LNG shipments into Europe, with Asian gas prices continuing to increase at the same rate as European gas prices and attracting the majority of US LNG cargoes in recent weeks.

Gas Storage Levels

Another key driver for the increases continues to be the low level of European gas storage. As a result of a cold winter and, more critically, a cold start to spring, European gas storage levels fell to their lowest recorded levels by mid-May, requiring high levels of injections throughout the summer and supporting unusually high demand for gas. In addition to the increase in physical demand, prices have also found support from the risk that storage levels will not have recovered sufficiently before the start of the winter heating season at which point we would expect injections to end and to see net withdrawals. This raises the prospect of running out of storage before the end of winter should we see particularly cold weather. So to some extent the price increases can be explained by supply/demand constraints, but also by the elevated risks for the coming winter leading to substantial buying interest.

Russian Gas Flows

In addition to high Asian gas prices and low storage levels, Russian gas flows have become more influential on the markets as the summer has progressed. Russian gas flows have remained significantly below the five-year average all year, despite the incentive of extremely high gas prices. Speculation has grown that this has been a political move in order to gain agreement for the Nord Stream 2 pipeline project which has met with significant opposition in the last 18 months, but which has now been completed and awaiting EU/German approval before gas can flow. In monthly auctions Gazprom has repeatedly declined to take additional available capacity through Ukraine and Poland, adding further fuel to the speculation that this has become political.

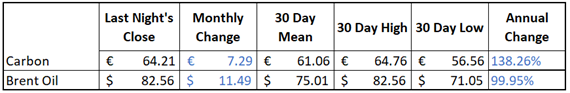

Oil Prices

Oil prices have also continued on their upward trend in recent weeks due to recovering Global demand and OPEC production cuts, and are threatening to break through a key resistance level of $86.29, their highs of 2018. Oil prices remain a driver for gas prices due to the volume of European and Asian gas contracts which are index-linked to oil prices. Any increases in oil prices can therefore be seen to contribute to increases in gas prices.

Summary

Given the level that gas and electricity prices have reached, it has become more difficult to predict where they will go from here. Although there are fundamental reasons for the increases as discussed above, it remains difficult to justify the scale that we have seen and therefore increases the likelihood that we will see a correction in prices at some point.

The markets are likely to react to any further news with regard to the potential start of the Nord Stream 2 pipeline which could offer some relief to supply concerns although it is still unclear as to whether we would see additional Russian gas flows or merely a re-routing of existing supplies to avoid Ukraine. The markets are also likely to react to updates in weather forecasts. Mild weather in the coming weeks would allow further injections into European gas storage sites and bring levels closer to normal, reducing the winter supply risk, whilst colder weather could see withdrawals from storage and an increase in supply risk.

These factors will also influence gas and electricity prices for next summer and beyond - if storage levels remain relatively low and we see a cold winter then there is a risk of a repetition of the conditions we have seen this year, with high injection demand supporting prices.

The only certainty is that prices will remain highly volatile.

6th October 2021